Sinking fund method of depreciation calculator

A Money accumulated. Under this method a fund know as depreciation fund or sinking.

Introduction To Sinking Funds Youtube

Solves for various items using the sinking fund depreciation method including depreciation book value Asset Value Salvage Valuehttpswwwmathcelebrity.

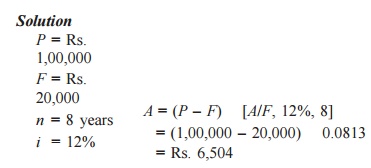

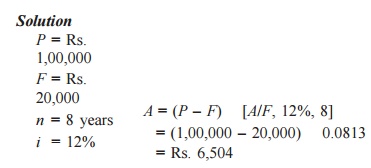

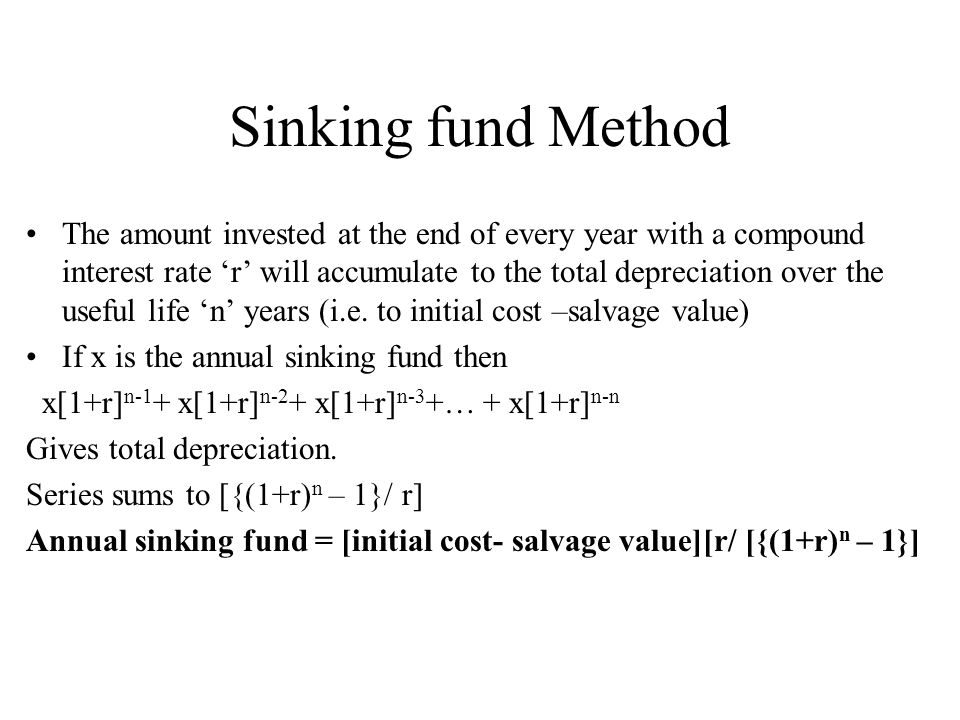

. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Using below data calculate. In the sinking fund method of depreciation a fixed depreciation charge is made every year and the interest is compounded on it annually.

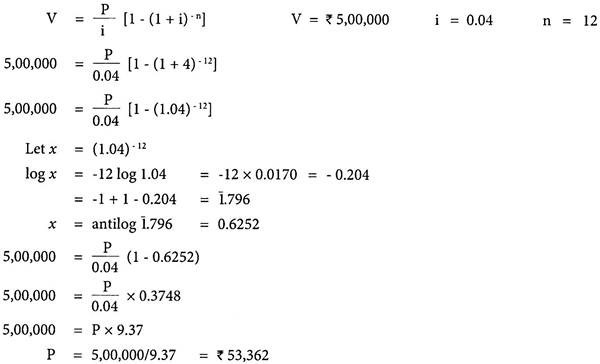

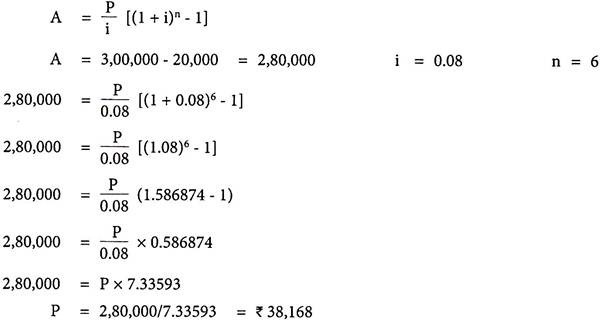

Example of the sinking fund method of depreciation. Enter value and click on calculate. The depreciation under this method can be calculated with the help of a Sinking Fund table for a particular period at a.

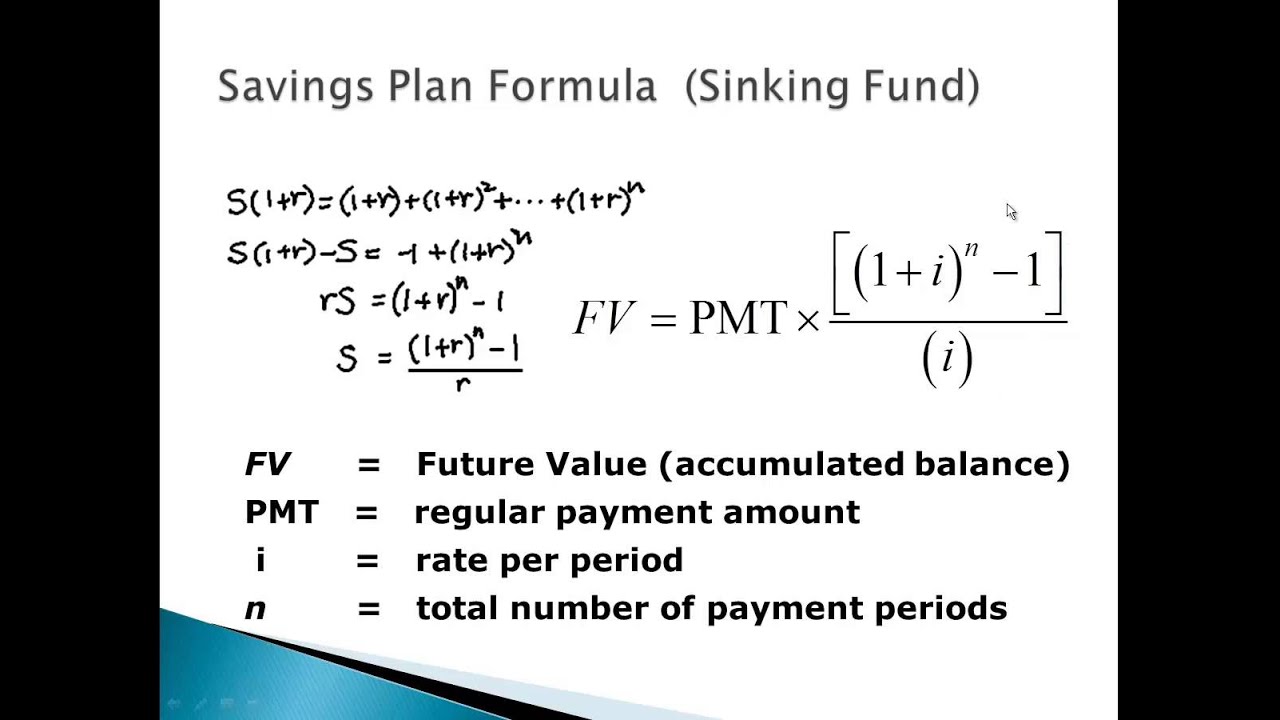

An alternative sinking fund formula simply subtracts the salvage value from the purchase cost without taking the present. Therefore five annual payments of 17390 earning 7 interest. An alternative sinking fund formula simply subtracts the salvage.

P Periodic contribution r Interest rate. What is a Sinking Fund. Sinking Fund Depreciation Calculator.

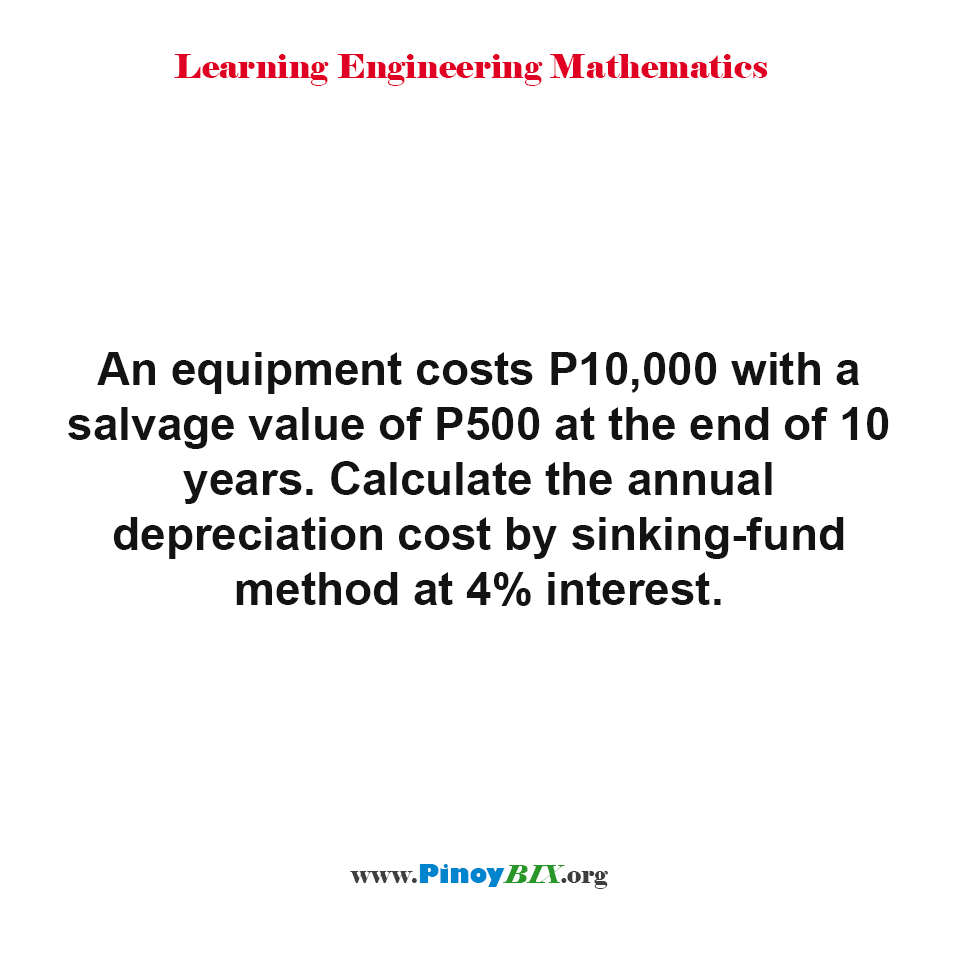

This math video tutorial is a part of a series of videos in the Subject Engineering Economy. The sinking fund method of depreciation is used when an organization wants to set aside a sufficient amount of cash to pay for a replacement asset when the current asset. How do you calculate sinking fund factor.

This method of depreciation is suitable for costly but wasting assets. Enter your search terms Submit search form. Purchase a machine on 01042012 on lease for 4 years for Rs 1000000-.

The sinking fund method of depreciation is used when an organization wants to set aside a sufficient amount of cash to pay for a replacement asset when the current asset reaches the. Under straight-line depreciation this would work out to a depreciation expense of 151631 a year for five years. A and B Pvt.

It decided to provide cash for. Depreciation fund method is also know as sinking fund method or amortization fund method. In this a fixed amount is periodically set aside in a special account to accumulate.

Build Your Future With a Firm that has 85 Years of Investment Experience. If we want to calculate the accumulated value in the sinking fund we can use the following formula. Sinking fund method is a method of calculating depreciation for an asset in which apart from calculating depreciation it also keeps aside a fund for replacing the asset at the.

Result will be displayed. Sinking Fund Method. Calculate depreciation using diminishing balance method.

A sinking fund method is a technique for depreciating an asset in bookkeeping records while generating money to purchase a replacement for the asset. Calculate weight average cost of capital of a company XYZ using below assumption data. How do you calculate depreciation using the sinking fund.

The Sinking Fund Method is a technique used to calculate the annual Depreciation of an asset. For example for i 7 and N 5 years the sinking fund factor is equal to 01739. This particular video aims to explain the basic fundamental prin.

Sinking Fund Youtube

Solution Calculate The Annual Depreciation Cost By Sinking Fund Method At 4 Interest

How To Calculate Sinking Fund Method Of Depreciation Youtube

Sinking Fund Method For Calculating Depreciation Qs Study

Methods Of Depreciation

Food Engineering Design And Economics Chapter V Depreciation Ppt Download

Food Engineering Design And Economics Chapter V Depreciation

Sinking Fund Method Of Depreciation Accounting Lecture Sabaq Pk Youtube

Sinking Fund Method Definition Functions Formula Benefits

Calculation Of Amortisation And Sinking Fund Firm Financial Management

Lesson 13 2 Sinking Fund Method Sfm Depreciation Methods Engineering Economy Youtube

Calculation Of Amortisation And Sinking Fund Firm Financial Management

Sinking Fund Method Definition Functions Formula Benefits

Economics Of Power Generation Part 2 Electricaleasy Com

Sinking Fund Method Of Depreciation Example Tutor S Tips

Deprecition Ppt Video Online Download

Sinking Fund Depreciation Method Calculator